May 15, 2024

As a business owner running a B2B company, you're regularly accepting business and corporate cards from your customers.

These transactions provide Level 2 and 3 credit card data, meaning that they’re secure transactions that qualify you for lower interchange rates from credit card brands like Visa and Mastercard.

While this should provide significant savings in terms of processing fees, not all Level 2 and 3 qualification is created equal. Each payment processor handles it differently, so it’s crucial to do your research to ensure you’re maximizing your savings and enjoying true B2B rates.

What Is Level 2 and 3 credit card data?

-

Level 1 data: Associated with consumer credit and debit cards.

- Basic details include card number and transaction amount.

-

Level 2 data: Associated with business, corporate, and government cards.

- Includes Level 1 data.

- Extra details such as customer’s tax ID, sales tax amount, and occasionally zip code.

-

Level 3 data: Associated with business, corporate, and government cards.

- Contains all components of Level 1 and 2 data.

- Additional details like item descriptions, quantities, and invoice numbers.

- Provides crucial information for accounting, inventory management, and cost analysis.

Transactions including Level 2 and 3 data benefit merchants because of the lower processing fees.

What other payment processors hide in merchant statements

While your current payment gateway may already be providing you with automated Level 2 and 3 qualification to save you money, many payment processors sneak in fees that negate most of your savings.

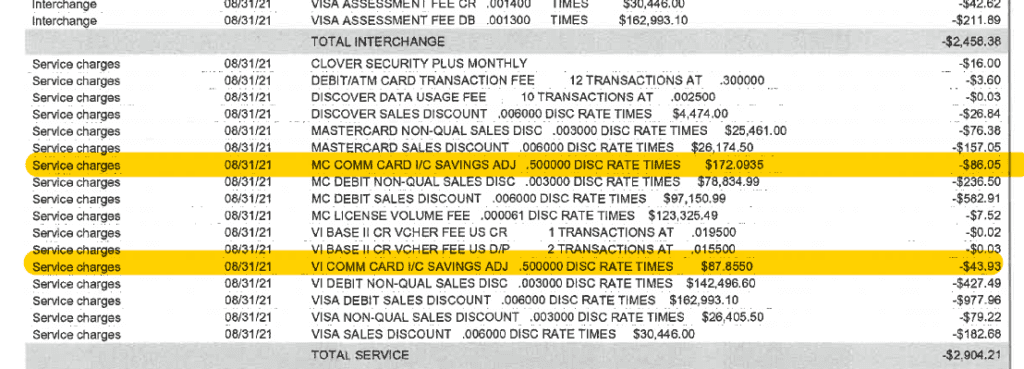

These fees are hidden as “savings adjustments” on your merchant statement.

What does this look like on a merchant statement?

An actual Quantum merchant provided us with this merchant statement they received from their previous payment processor. We highlighted the two “savings adjustment” service charges for visibility. It’s easy to miss this charge, especially because of how it’s worded. This payment processor charges the merchant a 0.5% discount rate, which is a rate for processing a discount that adds up quickly and cuts into profits.

How we handle Level 2 and 3 transactions differently

At Quantum ePay, we have a merchant-first mindset. We prioritize transparency and ethical practice and refuse to burn our merchants with hidden fees because we truly want their businesses to profit and succeed.

When it comes to Level 2 and 3 transactions with us, our proprietary Qoin payment gateway provides automated Level 2 and 3 qualification without any additional fees. It’s that easy.

Why Quantum is the top-rated payment processor in the US

Unlike most payment processors, Quantum ePay is a full-service independent sales organization (ISO), allowing us to build strong relationships with our merchants and provide personalized support every step of the way. And we really mean it: you can reach our dedicated team of specialists anytime to tailor the best solutions for your business.

We offer 24/7 multilingual merchant support, competitive rates, innovative technology, comprehensive reporting tools, experienced risk management, and so much more. If you’re ready to maximize your business’s revenue with Quantum ePay as your payment processor, click below to speak with a specialist now.